Calendar

Leading indicator

* Average workweek of production workers in manufacturing

* Building permits,

* Unemployment claims,

* Money supply,

* Inventory changes such as Change in manufacturers' unfilled orders, durable goods, New orders for consumer goods and materials

* Change in sensitive materials prices

* Stock prices.

* Contracts and orders for plant and equipment

Financial and sociopolitical factors

The role of interest rates. Using the interest rates independently from the real economic environment .Forex consists of simultaneous transactions in two currencies, then it follows that the market must focus on two respective interest rates as well. Traders react when the interest rate differential changes, not simply when the interest rates themselves change. A move on the discount rate and interest rate may generate changes in both differential and the exchange rate. Traders are doing trade on expectation and facts. If the discount rate was changed for political rather than economic reasons, a common practice in the European Monetary System, the markets are likely to against the central banks, sticking to the real fundamentals rather than the political ones. The market professed those interest rates as artificially high and, so that they are sold the respective currencies. Finally, traders deal on the perceived importance of a change in the interest rate differential.

Political crises influence. A political crisis is usually dangerous for the Forex because it may generate a spiky decrease in trade volumes. Prices under certain circumstances dry out quickly, and sometimes signal jump from 5 pips to 100 pips. Predictable political issue may impact the currency. Currency traders need to prepare for crises. The traders should react as fast as possible to avoid big losses. Forex market will be mess up during the political crisis period. Therefore, traders should sensitive to daily news about government movement

Employment Indicators

Consumer spending indicators. Products sales are a significant consumer-spending indicator for forex traders, as it proves the strength of consumer demand as well as consumer confidence. CSI will induce high economical growth in a country and hence currency will be increase. In Forex, traders need to analyze data such as the unemployment rate, manufacturing payrolls, nonfarm payrolls, average earnings, and average workweek. Generally, the most significant employment data are manufacturing and nonfarm payrolls, followed by the unemployment rate.

Employment Cost Index ( ECI ). The Employment Cost Index measures the relative changes in wages, benefits, and bonuses for a specific group of occupations. Consumer Spending Indicators show on data of the retail sale volume which is important for the Forex because it shows the level of consumers demand and their sentiments. The productivity report indicates that the ECI can reveal whether the increased cost of labor is justified or not.

Retail Sails. Retail sales are a significant consumer-spending indicator for foreign exchange traders, as it shows the strength of consumer demand as well as consumer confidence. For a well development country, consumers are playing important role in economy aspect. If the consumers have enough discretionary income to spend on their daily demand, on the other hand there will be more supply or imported goods. Forex traders may need to focus on the sales report by end of the year. In September, this is the back to school month whereas December has seasonal sales activities. Therefore, forex traders have to study the retail sales report in November. Some seasonal sales activity brings fewer profit margins and the reason is because of the discount promotion or clear stock purpose. Traders watch retail sales closely to gauge the overall strength of the economy and, consequently, the strength of the currency.

Consumer sentiment . It’s a survey of households that is designed to gauge direct the individual propensity for spending money over the past and coming year as well as the evaluation and expectation on economy outlook.

Auto sales.The level of auto sales is an economic indicator as a reference for forex traders . Car manufacturing increase country profit margin while export to overseas. When car import, tax are collected by government. The Auto sales are one the main products which can generate high income for a country and directly influence currency exchange market. But if the car does not manufacture locally, the figure cannot be take into data for forex analysis.

Merchandize Trade Balance

1. Food & beverages

2. raw material

3. consumer goods

4. autos

5. capital goods

6. other merchandise

Industrial sector indicators

Capacity utilization indicator equal to the total output of industry divided by total production capability. It refers to the maximum output of production plant in a normal business conditions. Capacity utilization is not a major economic indicator for forex market. However, this is the substance that is useful for fundamental analysis. A "normal" figure for a steady economy is 81.5 percent. If the figure reads 85 percent or more, it means that the industrial production is overheating, which close to full capacity. High capacity utilization rates induce inflation, and forex market may expect bank to increase the interest rates in order to avoid or against inflation.

Factory orders refer to the total of durable and nondurable goods orders. The factory orders indicator has limited significance for forex traders.

Nondurable goods are those products with life span not more than three years. For instance, food, clothing, light industrial products.

Durable goods orders are those products with a life span of more than three years. For example appliances, furniture, jewelry, and electronic products. They are divided into four major categories: primary metals, machinery, electrical machinery, and transportation. In order to eliminate the volatility pertinent to large military orders, the indicator includes a breakdown of the orders between defense and non-defense.

How can forex traders analyze from the data?

This data is fairly important to forex markets due to a good indication of consumer confidence. If durable goods cost more than nondurable, a high number in this indicator shows consumers' propensity to spend. Therefore, a good figure shows the bullish of the domestic currency.

Business inventories are the items produced and stored for future sale. The compilation of this information determines the situation of business of the market. Moreover, financial management and computerization help control business inventories in exceptional ways. Therefore, this indicator is not much important for the forex traders.

Inflation indicators

Producer price index (PPI). The compilation of most sectors of the economy, such as manufacturing, mining, and agriculture. PPI does not include imported goods, services, or taxes. It measures the average change over time in the selling prices received by local producers for their output. For PPI calculator, refer to http://www1.jsc.nasa.gov/bu2/inflation/ppi/inflatePPI.html

Consumer price index (CPI). Reflects the average change in retail prices paid by most consumer for a fixed market basket of goods and services. The CPI data is obtained from a sample of prices for food, shelter, clothing, fuel, transportation, and medical services that people purchase in daily basis.

For example, in 2000, you buy a book cost $10 and then in 2006 the same book will cost $11.76.

Formula:

CPI in 2000 = 110.88

CPI in 2006 = 130.4

Price in 2000= Price in 2006( 2000 CPI /2006 CPI)

$10=$11.76 (110.88/130.4)

Gross national product implicit deflator. It’s calculated by dividing the current dollar GNP figure by the constant dollar GNP figure.

Gross domestic product implicit deflator. It’s calculated by dividing the current dollar GDP figure by the constant dollar GDP figure.

Commodity research bureau's (CRB) futures index . An equally weighted index of 21 commodities, commonly used to gauge the effects of inflation.

The “Journal of Commerce” industrial price index (JoC). Consists of the prices of 18 industrial materials and supplies processed in the initial stages of manufacturing, building, and energy production.

Construction Data

1. real estate development and approval

2. new housing sales and second hand housing offered;

3. construction expenditures

Construction indicators are recurring and very sensitive to the level of interest rates and the level of disposable income. Sometimes, the bank issue low interest rates also won’t help to generate a high demand for housing. As happened in U.S. 1990, low mortgage rates only cause housing increased marginally, due to the low employment rate in a weak economy period. Housing level about between one and a half and two million units indicates a strong economy, whereas around one million units imply that the economy is in downturn.

Economic Indicators

The Gross Domestic Product (GDP). The Gross Domestic Product is the total of all goods and services produced in the United States , either by local or foreign companies.

Consumption Spending. Consumption is made probably by own basic income and discretionary income. The decision to spend or to save is depends on customers. Consumer confidence level is also measured as an important indicator to switch the tendency of customer from saving to buying.

Investment Spending. Investment — or gross private domestic spending — is the fixed investment and inventories.

Government Spending. Government spending is very influential and its impact on other economic indicators because of other expenses.

Net Trade. Worldwide internationalization and the economic and political developments when the United States able to compete overseas. Net trade can be approached in two ways: flow of product and flow of cost.

Forex Broker Study

The majority of the foreign exchange brokers execute business via phone using an open box system— there is a microphone with the broker that let him communication on the direct phone lines to the speaker boxes in the banks. By using this way, all banks can hear all the deals which are being executed. Due to the open box system, a trader is also able to hear all prices quoted; whether the bid was hit or the offer taken; and the following price. What the trader will not be able to hear is the amounts of particular bids and offers and the names of the banks showing the prices. Prices are unidentified. Sometimes brokers charge a commission that is paid equally by the buyer and the seller. The fees are negotiated on an individual basis by the bank and the brokerage firm. Brokers show their customers the prices made by other customers either two-way ( bid and offer ) prices or one way ( bid or offer ) prices from his or her customers. Traders show different prices because they "read" the market in a different way; they have different opportunity and different interests. A broker who has more than one price on one or both parties will automatically optimize the price.That means, the broker will always show the highest bid and the lowest offer. Therefore, the market has right of entry to an optimal spread possible. Fundamental and technical analyses are used for predicting the future direction of the currency. A trader might analyze the market by hitting a bid for a small amount to see if there is any response. Another advantage is that brokers might provide a broader selection of banks to their clients. Some European and Asian banks have overnight desks for 24 hours optimization dealing with counterparts in American banks, adding to the liquidity of the market.

Direct dealing .

Direct dealing is based on trading reciprocity. A market maker—the bank making or quoting a price — look forward to the bank that is calling to respond to making a price when called upon. Direct dealing provides more trading judgment, as compared to dealing in the brokers' market. Direct dealing used to be conducted mostly on the phone. Phone dealing was error-prone and slow which were difficult to prove and even more difficult to settle. Direct dealing was perpetually changed in the mid-1980s, by the introduction of dealing systems. Dealing systems are on-line workstations that link the contributing banks over the world on 1 on 1 basis. The performance of dealing systems is characterized by speed, reliability, and safety. The software is rather reliable in working on large exchange rates and the standard value dates. In addition, it is very accurate and fast in contacting with other parties, switching among conversations, and accessing the database. The trader is in continuous visual contact with the information exchanged through video conferencing. Video conferencing between both sides is much better than pure conversation. Most banks use a group of brokers and direct dealing systems. All approaches reach the same banks, but not the same parties, because corporations, for example, cannot deal in the brokers' market. While developing reciprocal relationship between traders and brokers, traders select their trading medium based on price quality, not on personal feelings. The market share between dealing systems and brokers fluctuates based on market conditions. Fast market conditions are beneficial to dealing systems, whereas regular market conditions are more beneficial to brokers.

Matching systems.

Contrasting dealing systems, on which trading is not unknown and is conducted on a 1 on 1 basis, matching systems are unknown and individual traders deal against the rest of the market, similar to dealing in the brokers' market. Nevertheless, not like the brokers' market, there are no individuals to bring the prices to the market, and liquidity may be limited at times. Matching systems are for smaller amounts.. In addition, credit lines are automatically managed by the systems. Traders input the total credit line for each counterparty. When the credit line has been reached, the system automatically disallows dealing with the particular party by displaying credit restrictions, or displays the only price for traders who have open lines of credit. As long as the credit line is restored the system allows the bank to deal again.

Trading Ideas

ASSESS - IDENTIFY - MOVE-IN - MOVE-OUT - EVALUATE

AIME is...

1. A systematic trading approach that relies on the same tools Forexmentor uses. The Forexmentor-AIME workshop will be grounded in the Forexmentor course, and focus is on the correct and practical application of Peter's system, using: Pivot Points, Candles, Patterns, MACD, Trendlines & "Insider" tips, tricks and everyday wisdom

2. AIME is a step-by-step method for trading currencies that teaches students to uncover opportunities, enter, monitor, and exit trades, and evaluate and really learn from any trade they make.

3. AIME is an acronym and stands for:

A = Access the market

I = Identify opportunities

M = Move into a trade ( enter ), M=Monitor the trade, M= Move out of the trade ( exit )

E = Evaluate the trade

AIME is an intense 2-day, hands on, " in the trenches" trading "WORK" shop

Economic Fundamental

On the other hand, Forex market is economic dependant among countries. Unlike the financial, political and crisis factors, economic factors occur in a steady stream. Therefore, its very import to keep an eye on the economic announcement in order to make the enter and exit decision on your position.

Some economic aspects:

1.Information source

Update the news on cnn or www.ny.frb.org , forexcapitalnews and so on.

2.Economic data

Measurable values of price and changes in price. For example, the cost to hire a stuff for a month, or the cost of a particular commodity.

3.Formulation of economic activity of relationship

Consumer spending, government spending, ratio of import and export activity, etc. 4 major consumer spending are clothing, food, living and transportation. The economy is considered growing if people switch to consuming from saving. Government spends on building the country facility, construction, government corporate and service, military, etc. A Country economy is growing if the export revenue is more than import demand. Or that means, country‘s income is more than its spending to get other countries’ goods. A strong country is considered independent by supplying significantly more than demanding.

4.Inflation rate

The specific inflation rate involves taking measurable prices, and a model of how people consume, and calculating what the general price level which is from the statistics model. For example, the fuel in U.S. is cost 1 USD 1 litre; To calculate the price level would require a model of how much petrol a person uses in average and what fraction of their income is devoted to this, another factor is how people use the petrol and whether there is any replacement for substitution.

5.Employment

This is another critical economic factor. Its basically measured in the stability of different job and satisfaction in sound.

6.Production

The production is playing important role nowadays as its chain-influence with other economic aspect. The measurable indicators are based on the change in material prices, Quantity orders for supplies and resources, change in manufacture’s durable goods and unfilled orders, sales and supply performance, Index of Production yield to customer expectation, expanding margin.

CHARTS

Tips: Most people will not consider side way pattern because the possibility to going up or ramping down is the highest. If you would like to trade in side way pattern situation. Here is your 5 sen.

* Play a bounce off resistance

* Play a break off resistance

* Play a bounce off support

* Play a break off support

* Wait for breakout. Don' t do anything.

CHARTS

Peter Bain use mainly daily, hourly, 15 minute, and five minute charts. The daily chart will help you define the overall trend from a position trading point-of-view, and the hourly (one hour) chart will give you a feel for the intraday trend. The 15 minute chart is used for entry and exit – with assistance from the five minute chart, where price is moving quickly, and you need to be closer to the action. Please note that the five minute is not to be used for scalping, as there is a lot of noise there, and you could easily get whipsawed.

Make sure you are using charts that are generated from the same data source that feeds the dealing engine, as is the case with both platforms mentioned above. That way, what you see is what you get when you buy or sell. Some charting packages do not ccurately reflect where price is at any given moment in time.

INDICATORS

Peter Bain really only espouse one – MACD (for divergence only). MACD Divergence is covered extensively in his course and my trading examples MACD is his favorite indicator, and that would be his choice.

The nine and 18 exponential moving averages are okay too to give you some sense of price direction, but he is not a believer in using moving averages for this market – so am not too thrilled about their application and use. Go ahead and plot MACD on the charts you are working with.

He will give you more information in tomorrow’s email on his simple, yet powerful Forex pivot trading system.

S1, S2, R1 and R2

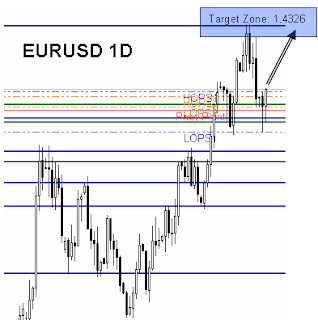

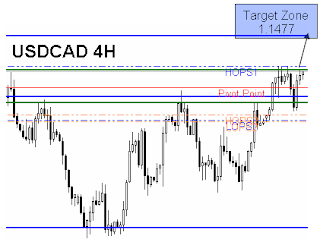

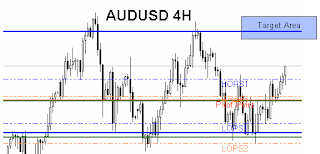

We used the calculation as showed before. But our support and resistance levels are different from others. We take the earlier session high and low and draw those levels on today’s chart. We’ll do the same to the session before the earlier session. By doing so, we are going to add in four more important levels drawn in our chart besides the pivot point .

LOPS1, low of the previous session.

HOPS1, high of the previous session.

LOPS2, low of the session before the previous session.

HOPS2, high of the session before the previous session.

PP, pivot point.

Those important levels will show us the strength of the market at anytime. The market will be considered as an uptrend market if it is trading above the pivot point. If the market is trading above HOPS1 or HOPS2, it is still considered as an uptrend market and we only take long positions. However, the market is considered as a downtrend market if it is trading below the pivot point. Trading below LOPS1 or LOPS2 is a downtrend market and it is advisable for us to take short trades.

The significance behind this calculation is simple. We all knew that the market stopped at some levels from going higher or lower than earlier session or the session before that because of some reasons. But yet, we don’t know the reasons. By then we only know the fact that the market upturned at that level. All the traders and investors should remembered that where the price stopped in the previous session, and the probability is that the market will upturn from there again (maybe for the same reason, and maybe not). If not, at least we can find some support or resistance at those levels.

Calculation of Pivot Point

Pivot point (PP) = (High + Low + Close) / 3

Below will be the example:

Open: 1.2386

High: 1.2474

Low: 1.2376

Close: 1.2458

The PP would be,

PP = (1.2474 + 1.2376 + 1.2458) / 3 = 1.2439

What is the message behind the number? It tells us about the market that trade above 1.2439, it is bull market. And if the market is trading below this 1.2439, it is likely to be a bear market. This kind of condition will continue until the beginning of next session.

Since Forex is a 24 hours market, we can take the open, close, high and low from each session at anytime. But the more accurate predictions is calculating at 00:00 GMT until the close at 23:59 GMT. There are also have support and resistance levels in this market.

There is other calculation of the PP as below:

Support 1 (S1) = (PP * 2) – H

Resistance 1 (R1) = (PP * 2) - L

Support 2 (S2) = PP – (R1 – S1)

Resistance 2 (R2) = PP + (R1 – S1)

H =High of the previous period

L =low of the previous period

Let’s say, PP = 1.2439

S1 = (1.2439 * 2) - 1.2474 = 1.2404

R1 = (1.2439 * 2) – 1.2376 = 1.2502

R2 = 1.2439 + (1.2636 – 1.2537) = 1.2537

S2 = 1.2439 – (1.2636 – 1.2537) = 1.2537

These levels are used to mark down the levels of support and resistance for the present session.

By using the same example above, the PP was calculated by using the information of the earlier session (the day before). From that, we can see clearly about the resistance and support levels. However, we also can use the previous weekly or monthly information in order to calculate the support and resistance levels. By doing so, we are able to notice the market flowing over a longer term. In addition, we are able to see the possible levels that the support and resistance levels might have achieved throughout the week or month. Most of the long term dealers calculated the pivot point by using the weekly or monthly data, and sometimes it also used by short term dealers in order to get a good idea about the longer term trend of the current market.

Pivot to Map Time Frame

Pivot point in Forex market is a turning point or condition. It is the market level changes from “bull” to “bear” or vice versa. It is a bull market if the market continues to go up level and if the market is expected continue goes down level, then it is a bear market. There are also have some support or resistance levels in the market. A possible bounce is considered reasonable if price can’t break the pivot point.

Pivot points function well in liquid markets as well as in other markets.

How does pivot point work? It simply works out with traders and investors use and trust, as well as bank and other traders’ companies. All the traders should know that pivot point is an important measurement for the strength and weakness of any market.

As already stated, the pivot point zone is a familiar technique as it works simply because of the use and trust from many traders and investors. But what about the other support and resistance zones (S1, S2, R1 and R2)? To predict something likely to happen for the support or resistance level with some mathematical formula in some way is quite subjective. We can not rely on that formula blindly merely because of the formula suddenly popped out on the level. For this reason, we have found another simpler alternative way to map our time frame, and somehow it is more objective and effective.

What we should know is that support and resistance levels are not merely a level resulting from the mathematical formula but they are measured objectively. These levels which have upturned there before have a higher probability of being more effective.

Mapping method works on trending and on sideways market conditions. In a trending market, it helps us determine the strength of the trend and trade off important levels. On sideways markets, it tells us about the possible turning levels.

How does our mapping method function?

Mapping method can function in three different ways such as

(i) As a trend identification (measure of the strength of the trend)

(ii) A trading system using important levels with price behavior as a trading signal

(iii) To set the risk reward ratio (RR) of any given trade based on where is the market relative to the previous session.

Pivot Forex

The levels for the trading ranges and pivots are the support and resistance levels of the market in the next time interval. It is important to note that the predicted levels only give the range in the next time interval.

They do not indicate when the levels will be reached by the currency price action. The pivot is a level at which the underlying asset can be expected to change direction and/or move rapidly away from.

DAILY PIVOT DATA

My pivots program provides not only Pivot, R1, R2, S1, and S2, but also the M1, M2, M3, and M4 points as well. It is common to find many traders calculating only the Pivot, R1, R2, S1, and S2 levels.

In the Forex market, however, you will find my additional points of support and resistance to be very significant indeed. These pivot data points are published daily and is available for access to you once you start the course. The Forexmentor video course also shows you how to calculate the Pivot points using our proprietary Pivot Calculator.

After you have calculated the pivot numbers for the day, place horizontal lines on your 15 minute and 1 hour charts at the pivot numbers for the day, or at least as many lines as your chart has room for. These pivot points will guide your trading throughout the day.

Learn Pivot Points

Pivot points are rarely understood and even rarely used by the Forex trader. However, they are gaining in popularity, once traders realize there is nowhere else to turn.

Used by professional floor traders, pivot trading is one of the oldest and most valuable technical trading methods available. Professional traders calculate pivot points in preparation for each trading sessions. The pivot lines system is an indispensable guide for making profitable decisions. For an active trader, the pivots can mean the difference between winning and losing.

WHY PIVOT POINTS WORK

Pivot points are 'super-sized' resistance and support levels. They are more important than normal resistance and support levels because they're objective, and it’s not easy to ‘read back into the data’ what a trader may be subconsciously looking for. Many indicators and pattern recognition systems used in technical analysis are subjective and prone to human error.

For example, two traders drawing Fibonacci lines might take entirely opposite trades because a Fibonacci line does not inherently contain rules for objectivity. The same goes for Elliot Waves (very prone to ‘oh that was the 2nd wave!’) and other common systems. Common technical analysis indicators like Parabolic SAR, EMA and others generate so many false signals it again becomes difficult to be objective in choosing combinations of indicators and knowing when to execute. This is why objectivity is the pivot points system’s greatest strength, as it takes the analysis out of the trader’s hands, and puts it in the capable, mathematical hands of the computer. Why are pivot points so good at forecasting short-term price levels? Pivot points are reflective of both short-term volatility and trader psychology.

10 Things You Should Beware

* Stay away from those who promise no financial free

* Beware of those everything sounds very easy.

* Don’t trade on Margin unless you have been trained

* Please take cautious to online/phony transferring cash in online trading

* Make sure its really interbank market

* Job offer as Account Executive might lead you to use your money for currency trading

* Need to ensure the company background

* Avoid those company who won’t let you know their background

* Don’t fully trust any agency or broker, put some effort to understand currency trading by yourself.

Risks Accessment Consideration

Trading currency exchange will carry certain level of risk which may not be fitting all investors' appetite. Prior to trading, investor should take consideration of their experience level, monetary objectives, financial management plan and risk-bearing.

Credit risk

Due to intended or unintended action by counter party, an outstanding currency position may not be paid off as agreed due to voluntary or involuntary action by counter party.

Replacement risk

When you cannot get refund from the counter party and induce your account deranges, instantly clear off your books to hold the currency price rate.

Settlement risk

Due to different prices at different time zones between you and your counter party, transaction payment might possible to be declared not enough money before payment is executed.

Exchange rate risk

Variation of currency rate is due to the worldwide market supply and demand. Price changes may bring to loss from profitable position.

Interest rate risk

Because of variation of currency rate, in forward spread , there might be some maturity gaps and transaction mismatch.

Dictatorship risk.

Dictatorship (sovereign) risk refers to the government's interference in the Forex activity. Ttraders have to realize that kind of the risk and be in state to account possible administrative restrictions.

USDJPY: A simple trading plan

The USDJPY right now trading just above the long term support level at 94.55, take a look at the chart below:

As long as the market keeps trading above the short term resistance level (95.13) I will look for long opportunities. An eventual break should take the market to 96.22

As long as the market keeps trading below the short term support level (94.61) I will look for short opportunities. An eventual break should take the market to 92.14

If the market keeps trading in between the short term range 95.13 and 94.61 I will do nothing.

USDCHF: A Simple Trading Plan

Blue line – Long term support zone

Green lines – Short term range

Here is my trading plan for the USDCHF:

If the market breaks the short term resistance up (1.0713) I will start to look for long trading opportunities.

If the market breaks the short term support down (1.0658) I will start to look for short trading opportunities.

EURUSD: A Simple Trading Plan

Definitely long opportunities are out of play at least for the time being, so what would be the trading plan for the EURUSD?

I will wait for the market to break 1.4107 (green support line) to look for short opportunities, if the Euro breaks this level down it should take it to 1.3868.

EURJPY: Trading Idea

Right now I’m waiting for the market to break either extreme of the range, but here is my plan:

If the market breaks 137.24 (green resistance line – short term resistance), I will look for long opportunities and it should take it to 139.85 (upper blue line – long term resistance zone).

If the market breaks 135.71 (green support line – short term support), I will look for short opportunities, this should take the market to 128.50.

EURUSD: Long opportunities in Play

Now that the EURUSD is trading just above all important levels, it should reach the next long term resistance level located at 1.4326.

So our Simple Trading Plan for the EURUSD is:

Just look for long opportunities in the short term charts (and ignore all short signals), as we said, all take profit orders will be placed just below the main resistance level located at 1.4326.

GBPUSD: Short trades in play

As long as the market continues to trade below 1.6327 I will look for short opportunities (already have one short). All take profit orders will be placed 40-50 pips above the main support zone.

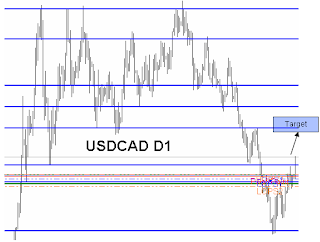

USDCAD, Close to net Long

Wait for the market to break 1.1359 and start looking for long opportunities.

EURUSD: Short or Long?

If the market breaks above the short term resistance level around 1.3932, I will start looking for long opportunities, targeting the long term resistance level around 1.4329

If the market breaks below the short term support level around 1.3798, it will validate the Head and Shoulders pattern, and I will start looking for short opportunities, targeting the long term support level around 1.3433

AUDUSD – Longs in Play

Look for long opportunities, all targets will be placed below the main resistance level around .8200

USDCAD: Longs in Play

As long as the USDCAD continues to trade above the main resistance level (1.1457), I will be looking for long opportunities targeting the next major resistance level around 1.1817

How to take a loss

One of the real culprits, I have to believe, is in the difficulty traders have in separating the reality of a losing trade from the psychological sense of feeling like a loser. At some level, many traders equate losing with being a loser. This frustrates them, depresses them, makes them anxious-in short, it interferes with their future decision-making, because their P & L is a blank check written against their self-esteem. Once a trader is self-focused and not market focused, distortions in decision-making are inevitable.

A particularly valuable section of the classic book Reminiscences of a Stock Operator describes Livermore 's approach to buying stock. He would sell a quantity and see how the stock responded. Then he would do that again and again, testing the underlying demand for the issue. When his sales could not push the market down, then he would move aggressively to the buy side and make his money.

What I loved about this methodology is that Livermore's losses were part of a grander plan. He wasn't just losing money; he was paying for information. If my maximum position size is ten contracts in the ES and I buy the highs of a range with a one-lot, expecting a breakout, I am testing the waters. While I am not potentially moving the market in the way that Livermore might have, I still have begun a test of my breakout hypothesis. I then watch carefully. How are the other averages behaving at the top ends of their range? How is the market absorbing the activity of sellers? Like any good scientist, I am gathering data to determine whether or not my hypothesis is supported.

Suppose the breakout does not materialize and the initial move above the range falls back into the range on some increased selling pressure. I take the loss on my one-lot, but then what happens from there?

The unsuccessful trader will respond with frustration: "Why do I always get caught buying the highs? I can't believe "they" ran the market against me! This market is impossible to trade." Because of that frustration-and the associated self-focus-the unsuccessful trader does not take any information away from that trade.

In the Livermore mode, however, the successful trader will see the losing one-lot as part of a greater plan. Had the market broken nicely to the upside, he would have scaled into the long trade and likely made money. If the one-lot was a loser, he paid for the information that this is, at the very least, a range-bound market, and he might try to find a spot to reverse and go short in order to capitalize on a return to the bottom end of that range.

Look at it this way: If you put on a high probability trade and the trade fails to make you money, you have just paid for an important piece of information: The market is not behaving as it normally, historically does. If a robust piece of economic news that normally sends the dollar screaming higher fails to budge the currency and thwarts your purchase, you have just acquired a useful bit of information: There is an underlying lack of demand for dollars. That information might hold far more profit potential than the money lost in the initial trade.

I recently received a copy of an article from Futures Magazine on the retired trader Everett Klipp, who was dubbed the "Babe Ruth of the CBOT". Klipp distinguished himself not only by his fifty-year track record of trading success on the floor, but also by his mentorship of over 100 traders. Speaking of his system of short-term trading, Klipp observed, "You have to love to lose money and hate to make money to be successful.It's against human nature what I teach and practice. You have to overcome your humanness."

Klipp's system was quick to take profits (hence the idea of hating to make money), but even quicker to take losses (loving to lose money). Instead of viewing losses as a threat, Klipp treated them as an essential part of trading. Taking a small loss reinforces a trader's sense of discipline and control, he believed. Losses are not failures.

So here's a question I propose to all those who enter a high-probability trade: "What will tell me that my trade is wrong, and how could I use that information to subsequently profit?" If you're trading well, there are no losing trades: only trades that make money and trades that give you the information to make money later.

Entering Trades

Market Order. Placing a market order means that you will buy at your brokers current "ask" price, or sell at your brokers current "bid" price, whatever that price currently is. For example, suppose you are buying EURUSD. The current market, as quoted by your broker or on GCI's "Dealing Rates" window, is .9152/56. This means that your broker is willing to buy EURUSD from you at .9152, and sell it to you at .9156. To place a market order to buy

Click on the rate (Sell or Buy) field within the order record or right click anywhere within the order record and then choose Market order command from pop-up menu. The Amount input screen will appear:

Enter desired amount measured in lots and press OK. New order marked with letter ‘I’ (Initiate) will appear on the Trader’s Orders window. Dealer now is able to confirm operation or to reject it due to market movement.

Stop Order. Initiating a trade with a stop order means that you will only have a position if the market moves in the direction you are anticipating. For example, if USDJPY is currently 128.50 and you believe it will move higher, you could place a "buy stop" at 128.60. This means that the order will only be filled if the market moves up to 128.60. The advantage is that if you are wrong and the market moves straight down, you will not have bought (because 128.60 will never have been reached). The disadvantage is that 128.60 is clearly a less attractive rate at which to buy than 128.50. Initiating a trade with a Stop order is usually appropriate if you wish to trade only with strong market momentum in a particular direction.

On the GCI system, you can enter a trade with a stop order by right-clicking on the appropriate currency rate in the "Dealing Rates" window, and then selecting "Entry Stop" from the pop up menu. You can then input the order size and price.

Limit Order. A Limit order is an order to buy below the current price, or sell above the current price. For example, if EURUSD is trading at .9152/56 and you believe the market will rise, you could place a limit order to buy at .9145. If filled, this will give you a long position in EURUSD at .9145, which is 11 pips better than if you had just bought EURUSD with a market order. The disadvantage of this Limit order is that if EURUSD moves straight up from .9152/56, your limit at .9145 will never be filled and you will miss out on the profit opportunity even though your view on the direction of EURUSD was correct. Entering a trade with a Limit order is usually appropriate if you believe that the market will remain in a range before moving in your anticipated direction, allowing the order to be filled first.

On the GCI system, you can enter a trade with a limit order by right-clicking on the appropriate currency rate in the "Dealing Rates" window, and then selecting "Entry Limit" from the pop up menu. You can then input the order size and price.

Trading Strategy

Before developing a trading strategy, a trader should have a working knowledge of technical analysis as well as knowledge of some of the more popular technical studies. Please visit these pages for detailed information.

Sample Strategy 1 - Simple Moving Average

Successful trading is often described as optimizing your risk with respect to your reward, or upside. Any trading strategy should have a disciplined method of limiting risk while making the most out of favorable market moves. We will illustrate one decision making model which uses a Simple Moving Average ("SMA") technical study, based on a 12-period SMA, where each period is 15 minutes. This is one example of a trading decision making strategy, and we encourage any trader to research other strategies as thoroughly as possible.

We will use a simple algorithm: when the price of the currency crosses above the 12-period SMA, it will be taken as a signal to buy at the market. When the currency price crosses below the 12-period SMA, it will be a signal to "Stop and Reverse" ("SAR"). In other words, a long position will be liquidated and a short position will be established, both with market orders. Thus this system will keep the traders "always in" the market - he will always have either a long or short position after the first signal. In the chart below, the white line represents the price of USDJPY, the purple line represents the 12-period SMA of USDJPY, and the red line indicates where USDJPY crosses above the SMA, generating a buy signal at approximately 129.90:

This is a simple example of technical analysis applied to trading. Many strategies used by professional traders make use of moving averages along with other indicators or "filters". Note that the moving average method has an element of risk control built in: a long position will be stopped out fairly quickly in a falling market because the price will drop below the SMA, generating a stop-and-reverse signal. The same holds true for a sell signal in a rising market. Note that the SMA is generated automatically by GCI's integrated charting application.

Please review the technical studies described in this site for additional resources on developing technical trading strategy.

Sample Strategy 2 - Support and Resistance Levels

One use of technical analysis, apart from technical studies, is in deriving "support" and "resistance" levels. The concept here is that the market will tend to trade above its support levels and trade below its resistance levels. If a support or resistance level is broken, the market is then expected to follow through in that direction. These levels are determined by analyzing the chart and assessing where the market has encountered unbroken support or resistance in the past.

For example, in chart below EURUSD has established a resistance level at approximately .9015. In other words, EURUSD has risen up to .9015 repeatedly, but has been unable to move beyond that point:

The trading strategy would then be to sell EURUSD the next time it gets close to .9015, with a stop placed just above .9015, say at .9025. This would have indeed been a good trade as EURUSD proceeded to fall sharply, without breaking the .9015 resistance. Hence a substantial upside can be achieved while only risking 10 or 15 pips (.0010 or .0015 in EURUSD).

On GCI's integrated charting system (GCI Multi-Currency Charts), the red support line shown above can be drawn by clicking on the "Trend" button at the top of the chart window, and then drawing a line by clicking the mouse once at the beginning of the line, and again at the end of the line.

Hedging

For example, if a trader buys 1 lot of USDJPY, he can then eliminate his exposure to a falling USDJPY by selling a second lot. On the GCI platform, this can be done by either right-clicking on the long USDJPY position and selectingn "Hedge" position from the pop-up menu (as pictured below), or by simply selling another lot from the "Dealing Rates" window.

This will result in one long position ("B") and one short positiong ("S") in USDJPY, as shown below. Note that these two positions do not offset and cancel each other.

The trader can then manage each position separately, using stops, limits, or market orders to close each "leg" at the most opportune time.

Exiting Trades

Exiting with a Market Order. Exiting a trade with a market order means that you will sell at your brokers current "bid" price, or buy at your brokers current "ask" price, whatever that price currently is. For example, suppose you had purchased one lot of USDJPY, meaning you are long one lot. If you then assume that the current market is 127.51/55, you know that you can exit your existing long position at 127.51 (that is, sell it to close at 127.51).

On the GCI system, this is done by right clicking on the open position in the "Open Positions" window. You can then select "close position" from the pop up menu, enter the lot amount you wish to close, and click "OK".

Exiting with a Stop. Exiting a trade with a stop order means that your position will be closed after an adverse market move of a specified amount. This does not necessarily mean that you have incurred a loss on the trade (see "trailing stops" below). For example, if you had purchased 1 lot of USDJPY and it is now trading at 128.50/54, you could place a Stop at 128.20. This means that the order will only be filled if the market moves down to 128.20, limiting your loss to .30 (30 pips).

On the GCI system, you can place an order to exit a position on a Stop order by right-clicking on the position in the "Open Positions" window, and then selecting "Stop" from the pop up menu. You can then input the order size and price.

A Trailing Stop is placed in the same manner, but the concept here is that the stop will be moved as the market moves in your favor (the stop "trails" the market"). So for example, assume that you had placed your stop at 128.20 with a long USDJPY position at 128.50. If USDJPY moves up to 128.90, you could then move the stop up to 128.60. This would ensure a worse case of a gain of .10 (10 pips), while still allowing unlimited upside if USDJPY continues to rise.

The advantage of exiting with a Stop is that (1) you limit your downside to the amount you specify with your stop, and (2) you have unlimited upside in the event that the market continues to move in your favor. The disadvantage is that markets will occasionally move adversely initially, causing your stop to be filled and closing your position, and then proceed to move in the direction that you had originally anticipated.

Exiting with a Limit Order. Exiting a trade with a limit order is an effective way to ensure that you will capture profits once your profit target is reached.

On the GCI system, you can place an order to exit a position on a Limit order by right-clicking on the position in the "Open Positions" window, and then selecting "Limit" from the pop up menu. You can then input the order size and price.

The advantage of exiting a trade with a limit order is that your position will be successfully closed if your profit target is reached, even if only for a few seconds. For example, if you purchased USDJPY at 128.50 and placed a limit order to exit the trade at 129.50, you will successfully capture a 1.00 profit (100 pips) if 129.50 is reached even briefly and then the market falls again. The disadvantage is that you will limit your upside, foregoing additional gains if the market was to continue to move in your favor. Furthermore, you will not limit your downside if the market moves against you. For example, if the market rises to 132.00, your profit will still be limited to the 100 pips because your position was closed at 129.50. If the market moves down below 128.50, your losses will not be limited, unless you had also placed a stop on the open position (see "exiting with a Stop" above.

Using Stops and Limits Together. A common strategy is to place both a Stop and a Limit on the same open position. On the GCI system, the position will be closed by whichever order is reached first, and the other order will automatically be cancelled. This is known as "OCO" or "One Cancels the Other".

Controlling Risk

Risk will essentially be controlled in two ways: 1) by exiting losing trades before losses exceed your pre-determined maximum tolerance (or "cutting losses"), and 2) by limiting the "leverage" or position size you trade for a given account size.

Cutting Losses

Too often, the beginning trader will be overly concerned about incurring losing trades. He therefore lets losses mount, with the "hope" that the market will turn around and the loss will turn into a gain.

Almost all successful trading strategies include a disciplined procedure for cutting losses. When a trader is down on a positions, many emotions often come into play, making it difficult to cut losses at the right level. The best practice is to decide where losses will be cut before a trade is even initiated. This will assure the trader of the maximum amount he can expect to lose on the trade.

The other key element of risk control is overall account risk. In other words, a trader should know before he begins his trading endeavor how much of his account he is willing to lose before ceasing trading and re-evaluating his strategy. If you open an account with $2,000, are you willing to lose all $2,000? $1,000? As with risk control on individual trades, the most important discipline is to decide on a level and stick with it. Further information on the mechanics of limiting risk can be found at the Exiting Trades pages and Hedging pages.

Determining Position Size

Before beginning any trading program, an assessment should be made of the maximum account loss that is likely to occur over time, per lot (see "Drawdown" in "Glossary of Terms"). For example, assume you have determined that your worse case loss on any trade is 30 pips. That translates into approximately $300 per $100,000 position size. Further assume that the $100,000 position size is equal to one lot. Five consecutive losing trades would result in a loss of $1,500 (5 x $300); a difficult period but not to be unexpected over the long run. For a $10,000 account trading one lot, this translates into a 15% loss. Therefore, even though it may be possible to trade 5 lots or more with a $10,000 account, this analysis suggests that the resulting "drawdown" would be too great (75% or more of the account value would be wiped out).

Any trader should have a sense of this maximum loss per lot, and then determine the amount he wishes to trade for a given account size that will yield tolerable drawdowns.

Placing Orders

Market Order. Placing a market order means that you will buy at your brokers current "ask" price, or sell at your brokers current "bid" price, whatever that price currently is. For example, suppose you are buying EURUSD. The current market, as quoted by your broker or on GCI's "Dealing Rates" window, is .9152/56. This means that your broker is willing to buy EURUSD from you at .9152, and sell it to you at .9156. To place a market order to buy

Click on the rate (Sell or Buy) field within the order record or right click anywhere within the order record and then choose Market order command from pop-up menu. The Amount input screen will appear:

Enter desired amount measured in lots and press OK. New order marked with letter ‘I’ (Initiate) will appear on the Trader’s Orders window. Dealer now is able to confirm operation or to reject it due to market movement.

Stop Order. Initiating a trade with a stop order means that you will only have a position if the market moves in the direction you are anticipating. For example, if USDJPY is currently 128.50 and you believe it will move higher, you could place a "buy stop" at 128.60. This means that the order will only be filled if the market moves up to 128.60. The advantage is that if you are wrong and the market moves straight down, you will not have bought (because 128.60 will never have been reached). The disadvantage is that 128.60 is clearly a less attractive rate at which to buy than 128.50. Initiating a trade with a Stop order is usually appropriate if you wish to trade only with strong market momentum in a particular direction.

On the GCI system, you can enter a trade with a stop order by right-clicking on the appropriate currency rate in the "Dealing Rates" window, and then selecting "Entry Stop" from the pop up menu. You can then input the order size and price.

Limit Order. A Limit order is an order to buy below the current price, or sell above the current price. For example, if EURUSD is trading at .9152/56 and you believe the market will rise, you could place a limit order to buy at .9145. If filled, this will give you a long position in EURUSD at .9145, which is 11 pips better than if you had just bought EURUSD with a market order. The disadvantage of this Limit order is that if EURUSD moves straight up from .9152/56, your limit at .9145 will never be filled and you will miss out on the profit opportunity even though your view on the direction of EURUSD was correct. Entering a trade with a Limit order is usually appropriate if you believe that the market will remain in a range before moving in your anticipated direction, allowing the order to be filled first.

On the GCI system, you can enter a trade with a limit order by right-clicking on the appropriate currency rate in the "Dealing Rates" window, and then selecting "Entry Limit" from the pop up menu. You can then input the order size and price.

Calculate Pip Values

(one pip, with proper decimal placement/currency exchange rate) x (Notional Amount)

Using USDJPY as an example, this yields:

(.01/130.46) x USD10,000 = $0.77

or 77 cents per pip

Using EURUSD as an example, we have:

(.0001/.8942) x EUR10,000 = EUR 1.1183

But we want the pip value in USD, so we then must multiply EUR1.1183 x (EURUSD exchange rate):

EUR 1.1183 x .8942 = $1.00

This is in fact a phenomenon you will see with any currency in which the currency is quoted first (such as EURUSD, GBPUSP, or AUDUSD): the pip value is always $1.00 per 10,000 currency units. This is why pip (or "tick") values in currency futures, where the currency is quoted first, are always fixed.

Approximate pip values for the major currencies are as follows, per 10,000 units of the base currency:

USD/JPY: 1 pip = $.77; In other words a change from 130.45 to 130.46 is worth about $.77 per $10,000.

EUR/USD: 1 pip = $1.00; .8941 to .8942 is worth $1.00 per 10,000 Euros.

GBP/USD: 1 pip = $1.00; 1.4765 to 1.4766 is worth $1.00 per 10,000 Pounds.

USD/CHF: 1 pip = $.59; 1.6855 to 1.6866 is worth $.59 per $10,000.

Overnight Interest

For example, in USDJPY, the interest rate differential is the difference between short-term U.S. interest rates and short-term Japanese interest rates. If, for example, U.S. interest rates are 5.0% and Japanese interest rates are 1.0%, the interest rate differential is 4.0% (5.0% - 1.0%). This means that if a trader was to sell USDJPY, he would have to pay 4.0% of the notional amount of the contract per year to hold the position. On one lot, the notional amount is $100,000, so the trader would have to pay approximately $4,000 to hold the position for one year. This translates to approximately $11.00 per day per lot for holding the USDJPY position ($4,000/365).

On the GCI system, these amounts are calculated for the trader and shown, as dollars per lot per day, in the "Currency Reference Rates" window under the columns "Prm Buy" and "Prm Sell":

US Dollar, Japanese Yen to Remain Volatile Ahead of Key GDP, CPI Reports

Risk trends remain a prominent driver of price action for the US dollar and Japanese yen, and next week may not be any different as Japanese GDP, Canadian CPI, US CPI, and meeting minutes from the Federal Reserve and Bank of England will all be released.

Japanese Gross Domestic Product (GDP) (4Q P) - February 15

On February 15 at 18:50 ET, Japan's Cabinet Office will release preliminary growth readings, and after two consecutive quarters of contraction in Q2 and Q3, the outlook doesn't look good. There are signs that businesses are suffering considerably at the hands of waning domestic and foreign demand. Consumers have very little to work with these days, as the jobless rate has been climbing slowly, and perhaps even worse, pre-tax earnings growth has actually fallen negative compared to a year earlier, according to the latest figures. Meanwhile, Japanese exporters have had to grapple with not only slowing global growth, but also the appreciation of the Japanese yen, all of which has led foreign-bound shipments to tumble a whopping 23.1 percent in Q4 2008, according to preliminary figures published by the Ministry of Finance. As a result, a Bloomberg News poll of economists shows expectations for GDP to fall 3.1 percent in Q4, with the annualized rate forecasted to plummet by the most since 1974 at a rate of 11.7 percent. This could hurt risk appetite during the Asian trading session, lead the Nikkei lower, and thus push the Japanese yen higher amidst deleveraging.

Bank of England Meeting Minutes (FEB 5) - February 18

The Bank of England's meeting minutes tend to be a huge market-mover for the British pound upon release at 4:30 ET, and this time is unlikely to be any different. During the February meeting, the BOE's Monetary Policy Committee (MPC) slashed the Bank Rate by 50 basis points to yet another record low of 1.00 percent, as expected. However, the British pound subsequently rallied as the MPC suggested that they may not cut rates again on March 5. Since then, though, BOE Governor Mervyn King's comments have signaled otherwise and if the MPC's comments and outlooks signal that the central bank will reduce the Bank Rate further, the British pound could pull back.

Federal Open Market Committee (FOMC) Meeting Minutes (JAN 27-28) - February 18

In January, the Federal Open Market Committee (FOMC) left the fed funds target range at 0.0 percent - 0.25 percent, and the minutes from the meeting will likely add to indications that they will leave the target unchanged throughout much of 2009. In fact, the FOMC said in their post-meeting statement that their focus had shift to “support the functioning of financial markets and stimulate the economy through open market operations and other measures that are likely to keep the size of the Federal Reserve's balance sheet at a high level.” The minutes may have an impact on risk trends if the Committee's outlook proves to be more bearish than currently perceived. However, if the news happens to be positive for the stock markets, it may also be negative for the greenback, which has been trading solely as a safe-haven asset lately.

Canadian Consumer Price Index (CPI) (JAN) - February 20

In January, the Bank of Canada issued forecasts for sharp declines price growth this year, making the February 20 release of the Canadian Consumer Price Index (CPI) quite important. At 7:00 ET, CPI for January is anticipated to contract for the fourth straight month at a rate of 0.3 percent while the annualized pace is forecasted to slip to a 2-year low of 1.1 percent. Meanwhile, the Bank of Canada's core CPI measure may actually hold relatively high at 2.2 percent, though this would be down from a 1.5 year high of 2.4 percent. Given the sharp drop in commodity prices since the summer and slowing in the Canadian economy, there is potential for weaker-than-expected readings and thus, the Canadian dollar could pull back further.

US Consumer Price Index (CPI) (JAN) - February 20

At 8:30 ET, the release of the January reading of the US Consumer Price Index (CPI) could lead the term “deflation” to be used abundantly in coming weeks and months (one that became very popular in November, according to Google Trends). Indeed, CPI is forecasted to have edged a slight 0.1 percent higher during January, while the annual rate is anticipated to have fallen negative for the first time since 1955 by 0.1 percent. Excluding volatile food and energy prices, though, core CPI may have risen 0.3 percent during the month, leaving the annual rate to fall to a nearly 5-year low of 1.5 percent.

Disclaimer

Investment in the currency exchange is highly speculative and should only be done with risk capital. Prices rise and fall and past performance is no assurance of future performance. This website is an information site only. Accordingly we make no warranties or guarantees in respect of the content. The publications herein do not take into account the investment objectives, financial situation or particular needs of any particular person. Investors should obtain individual financial advice based on their own particular circumstances before making an investment decision on the basis of the recommendations in this website. While we try to ensure that all of the information provided on this website is kept up-to-date and accurate we accept no responsibility for any use made of the information provided. All intellectual property rights are the property of Daily FX. Daily FX and its affiliates, will not be held responsible for the reliability or accuracy of the information available on this site. The content herein is provided in good faith and believed to be accurate, however, there are no explicit or implicit warranties of accuracy or timeliness made by Daily FX or its affiliates. The reader agrees not to hold Daily FX or any of its affiliates liable for decisions that are based on information from this website. Daily FX highly recommends that before making a decision, the reader collects several opinions related to the decision and verifies facts from at least several independent sources.

Weekly Focus: Protectionism Back on the Agenda

There will be a lot to talk about at this weekend's G7 meeting. Obviously, the financial crisis and how to handle it will be an important theme. However, another pressing issue has emerged recently: Growing signs of protectionism. The US stimulus package, for instance, includes a ‘Buy American' provision requiring that only US materials be used in construction projects funded by the bill. The Buy American clause has been heavily criticised by both the EU and Japan, so the bill has now been softened. It now states that the US will not violate international trade agreements, including WTO and NAFTA rules. How this will be carried into practice is still uncertain, though.

In Europe, France in particular seems to be cultivating its own interests, with a EUR6bn car industry bailout that requires French companies benefiting from the package to stay in France for at least five years. In a dispute with the Czech Republic, French President Sarkozy said that he would encourage French companies - for example, in the Czech Republic - to move their operations back to France. Naturally, this met with heavy protests from the Czech Republic, and the EU has asked for further information on the planned bailout for French carmakers.

Although protectionism is always looming when the world economy is in a crisis, until recently protectionist pressures were largely contained. Recent developments are ominous, though, underlining how important it is for the G7 to take control of the situation very soon. Waging a trade war would simply obstruct a solution to the global economic crisis and be much like scoring a huge own goal - witness the Great Depression of the 1930s, when protectionism just made matters worse.

Euroland: ECB to reach 1% by the summer

Due to a softer rhetoric from the ECB lately and the more downbeat outlook for the Euroland economy we have revised down our forecast for ECB rates (See Flash Comment - Euroland: ECB expected to reach 1% by Summer). We now see the end point at 1.0% rather than 1.5%. We continue to look for a 50bp easing at the March meeting but now expect the ECB to ease by a further 25bp in April and 25bp in June. Why not cut all the way to zero? We believe the expected improvement in PMIs globally will lead the ECB to stop cutting rates when we reach the summer. By then, PMIs should have risen for five to six months and more positive signs in the US are likely to have evolved. This will put the ECB on the sidelines to wait for the stimulus to work.

During the week the ECB's Weber - one of the arch-hawks - gave an interesting speech. He said that "We should not at this point avoid to lower rates aggressively, because we understand at the current juncture all indicators look like the economy is in freefall.” (See Flash Comment - Euroland: Weber confirms shift in ECB focus). The ECB seems to have set aside its aversion to cutting rates to a very low level. That the economy is in freefall was clearly confirmed by Q4 GDP data this week. German GDP fell a whopping 2.1% q/q - weaker than the consensus expectation of -1.8%. Euroland GDP as a whole fell 1.5% q/q. Highlighting the woes for the auto industry in Europe, numbers showed that car sales in Western Europe fell 26.9% y/y in January.

Softer rhetoric from the ECB and weak data has added downward pressure to Euroland yields. Helping in this direction was also the aggressive rate cut from the Riksbank of 100bp and a very dovish Bank of England pointing to zero rates before long (see UK). EUR/USD has traded broadly sideways over the past week at around 129 but we expect it to resume the move lower over the coming months.

Key events of the week ahead

- Tuesday: ZEW likely to rise further and signal gradual improvement in surveys in general.

- Friday: Flash PMI should recover further in February as the pace of decline in activity tapers off. It will still signal very weak growth, though.

Switzerland: Banks in the spotlight

In Switzerland, the past week has been all about the banks' annual results. Tuesday saw the country's biggest bank, UBS, release miserable results, with total losses for 2008 of CHF19.7bn, and on Wednesday its second-largest bank, Credit Suisse, published losses for the year of CHF8.2bn. While writedowns and losses in the financial sector do not in themselves affect growth in Switzerland, these results do illustrate the difficult environment for financial companies, and we expect the financial sector to continue to make a negative contribution to growth in Switzerland. The sector contributed up to half of overall Swiss economic growth in 2005-07, but throughout last year it practically cut the country's growth in half. Both banks also announced plans for redundancies: Credit Suisse said that it would be cutting 5,300 jobs, and UBS announced a further 2,000 job losses. Despite the big financial package in the autumn and the successful recapitalisation of the banks, UBS in particular has remained one of the hardest-hit global banks, and the financial sector is still - thanks to a large share of the economy by international standards - a significant risk factor for both growth and the CHF.

The week also brought important inflation data. There was a surprisingly big drop in CPI inflation from 0.7% in December to just 0.1% in January. As elsewhere in the world, the slide in commodity prices played a major role in this, with oil products alone contributing a drop of 1.3pp relative to last year. Prices of foreign manufactured goods also fell by 3.8% y/y, pulling down inflation by 1.1pp, which would support the argument that the slowdown in global demand has pushed down prices. But with inflation well below the 2% target and there being a risk of a lengthy period of falling prices, the pressure is on the SNB to ease monetary policy further, although the bank is continuing to maintain that the recent big drops in prices are only temporary.

We have published a new interest and exchange rate forecast today (Friday). Our forecast for the SNB's interest rate target is unchanged - we expect this to stay at 0.50% for the rest of the year. However, we think it likely that the SNB will lower the upper end of the band for the 3M LIBOR. We also expect the bank to use alternative instruments to ease monetary policy (such as purchases of corporate and/or government bonds), and have therefore revised down slightly our yield forecast for longer maturities. We have not changed our forecast for the CHF.

Key events of the week ahead

- Tuesday, 09.15 CET: December retail sales. The series is usually rather volatile, but it will still be interesting to see how Christmas trading was affected.

- Thursday, 08.15 CET: January trade balance.

- Thursday, 11.00 CET: ZEW expectations.

UK: Bank of England to follow in Fed footsteps and introduce ZIRP

The Inflation Report this week from the Bank of England (BoE) pointed to further clear downside for interest rates. The BoE painted a very bleak picture of the British economy and paved the way for further easing. The most striking feature in the Inflation Report was the BoE's forecast of inflation. The BoE expects inflation to be only around 1% in the medium term based on current market rates and estimate that the economy will still have a lot of excess capacity on this horizon. This means that even if the BoE cuts rates to zero it would not be enough to push the medium-term inflation rate up to the target of 2%. This is a clear signal that the BoE will indeed cut rates as low as possible - zero - and probably introduce quantitative easing. We can therefore expect the BoE to start buying credit assets without financing this with short T-bills - and hence print money to buy credit assets. This is similar to what the Fed is doing in the US mortgage market, where it buys mortgage-backed securities without funding it with treasuries.

Based on the Inflation Report we now expect the BoE to cut rates to zero in two steps - a 50bp cut in March and a further 50bp cut in April. There is also the possibility that it will cut by the entire 100bp in March. Whether it goes all the way to zero - or as the Fed uses a range of 0-25bp - is not clear. It might choose to have a slight positive interest rate due to technical issues surrounding money market funds.

The minutes from the latest BoE meeting will be released next week and might give more insight into the BoE's thinking. Otherwise focus turns to data for CPI and retail sales. In the past week we saw a little light in terms of the BRC retail sales monitor, which showed a slight improvement. It may be that the stimulus from lower rates and rapid decline in commodity prices is starting to have a stabilising effect. The level of growth is still very low, though, and hence pressure to give more help is still in place.

Key events of the week ahead

- Monday: Rightmove house price index could rise m/m as indicated by the HBOS number last week.

- Tuesday: CPI likely to show further decline in inflation.

- Wednesday: BoE minutes (see above). CBI industrial survey to stay weak.

- Friday: Retail sales might improve as signalled by BRC.

USA: Obama's financial rescue plan leaves many questions unanswered

Stateside, the week was all about fiscal policy. Congress managed to agree on a fiscal policy stimulus package running to USD789bn, equivalent to around 6% of GDP. Thus the overall package is only marginally smaller than the original USD819bn proposal from the House of Representatives.

Centre stage, though, was Treasury Secretary Timothy Geithner's unveiling of Barack Obama's rescue plan for the financial sector. The overall impression of the plan is that it leaves more questions unanswered than one might have hoped (see Research US: A united rescue effort, but short on detail). There had been a great deal of speculation about the creation of a federal ‘bad bank' that could take over the toxic assets that are creating uncertainty about banks' solvency, but the new Financial Stability Plan does not provide for a fully government-financed bad bank. Instead there will be a public-private investment fund which will buy up toxic assets for which there is otherwise no market. There are no clear answers yet as to how the fund is to attract private investors, how the risk associated with its assets will be shared, or how prices will be set. All larger banks will also be subjected to a stress test to see whether they have sufficient capital to withstand future losses. Banks that have undergone this stress test will then be eligible for a federal capital injection.

Taken as a whole, the rescue plan will probably remove much of the uncertainty about individual banks' state of health. But with so few details in place and an extensive stress test to be completed first, the plan will take time to implement.

The most interesting incoming data in the coming week are consumer prices for January. We expect the overall CPI to be unchanged from December, with core inflation at 0.2% m/m. The minutes of the FOMC meeting on 27-28 January are due to be released on Wednesday, and it will be interesting to see how much the FOMC members discussed buying up treasuries. The week also brings a number of speeches by FOMC members, the most important coming from Ben Bernanke on Wednesday.

Key events of the week ahead

- Tuesday: We expect the NAHB housing index to drop to 7.

- Wednesday: Minutes of the January FOMC meeting, a speech from Ben Bernanke, and data for housing starts, building permits and industrial production in January.

- Thursday: We expect producer prices to climb 0.3% m/m overall and 0.2% m/m ex. food and energy.

- Friday: We expect the consumer prices to be unchanged from December and core inflation at 0.2% m/m

Asia: Japanese growth to plummet in Q4

In Japan, the big event of the week is the release of GDP figures for Q4 08. We expect GDP to contract by no less than 2.5% q/q. It is primarily exports that dragged the economy down during the quarter. Our calculations indicate that exports fell by 12% q/q, with the result that net exports knocked a whole 2.0pp off growth from Q3 to Q4. This massive drop in exports has hit both business investment and the labour market, and so the GDP figures will be weak across the board. We expect private consumption and business investment to fall by 0.9% q/q and 2.5% q/q, respectively. The greatest uncertainty is associated with stocks. We expect stockbuilding to boost GDP growth by 0.3pp q/q, but the figure may well turn out to be higher. This heavy stockbuilding in Q4 means that the growth outlook for Q1 this year is also weak. We currently anticipate further contraction of 0.8% q/q, but we hope to see some stabilisation of activity during Q2.

We expect the BoJ to keep its leading rate unchanged at 0.1% at the monetary policy meeting on Wednesday and Thursday. Anything else would be an enormous surprise. The bank has signalled clearly that it does not want to take its leading rate right down to zero, as this would jeopardise the functioning of the money markets. Interest will therefore centre on any new unorthodox easing. The BoJ has already announced plans to buy financial institutions' commercial paper and shares, and it is possible that the bank will announce concrete plans to buy corporate bonds in connection with the monetary policy meeting. However, it is important to stress that the main problem in Japan is not the banks' inability or unwillingness to lend. The country's weak growth is due primarily to a huge external demand shock. This means that the weak fiscal policy reaction and political uncertainty are ultimately a bigger problem at the moment than the financial sector's woes.

In China, no important news is expected in the week ahead. Economic data are still painting the picture of an economy that has begun to stabilise at the beginning of this year. The rapid acceleration in credit growth from 18.7% in December to 21.3% y/y in January is another sign that the effects of more expansionary monetary and fiscal policy are beginning to feed through. Although inflation will probably remain negative during the spring, the pressure for aggressive easing of monetary policy is abating. We have therefore reduced the degree of monetary policy easing in our forecast for China, see Flash Comment - China: Inflation to temporarily enter deflationary territory.

Key events of the week ahead

- In Japan, Monday brings GDP figures for Q4, while Thursday's monetary policy meeting at the BoJ is expected to result in an unchanged key rate of 0.1%.

- No important data are expected out of China during the week.

Foreign Exchange: Zero Interest Rate Policy taking its toll on GBP and SEK

During the past month, two trends emerged in the FX market: broad based euro weakness - as the single currency lost against all G10 currencies, but the Swiss franc and the New Zealand dollar - and a very strong appreciation of Norwegian krone. Both movements were in line with our general forecasts, although the strong Norwegian krone rally came sooner than we had expected.